portland oregon sales tax rate 2020

Oregon OR Sales Tax Rates by City. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers.

If I Buy A Car In Another State Where Do I Pay Sales Tax

The tax rate or mill-rate is charged per 1000 of tax assessed value.

.jpg)

. Portland Sales Tax Calculator. Oregon cities andor municipalities dont have a city sales tax. The company conducted more than 200 transactions to South Dakota.

Sales Tax Calculator Sales Tax Table. A home tax assessed at 242000 a real market value of 390K with a mill-rate of 1640 would owe annual property taxes of 3968. The County sales tax rate is.

LoginAsk is here to help you access Portland Oregon Sales Tax 2020 quickly and handle each specific case you encounter. The Portland sales tax rate is. Oregons sales tax rates for commonly exempted categories are listed below.

The December 2020 total local sales tax rate was also 0000. Oregon is one of five states with no statewide sales tax but Oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion. The Oregon use tax is a special excise tax assessed on property purchased for use in Oregon in a jurisdiction where a lower or no sales tax was collected on the purchase.

Many other states are formalizing guidance through laws and regulations regarding collecting sales tax on online sales. View City Sales Tax Rates. Oregon State Tax Quick Facts.

The current total local sales tax rate in Portland OR is 0000. Taxfilers must file their business tax returns and pay their business tax liability at the same time they file their federal and state income tax returns generally April 15 for calendar year taxfilers. For more information and a flowchart to determine if vehicle use tax is due.

The 2018 United States Supreme Court decision in South Dakota v. 2020 Tax Rate 475 675 875 99 Single and Separate 3600 3600 - 9050 9050-125000 125000. 090 average effective rate.

To this end we show advertising from partners and use Google Analytics on our website. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. The tax established by the Business License Law is 22 percent of adjusted net income for tax years beginning on or before December 31 2017.

Please complete a new registration form and reference your existing account 3. Some rates might be different in Portland. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0.

In 2002 the inflation index changed from the Portland CPI to the US. Sales tax region name. While many other states allow counties and other localities to collect a local option sales tax Oregon does not permit local sales tax es to be collected.

2020 rates included for use while preparing your income tax deduction. In the Portland Metro area mill-rates range from 1500 to 2030. Redmond OR Sales.

The first thing to know about the state of Oregons tax system is that it includes no sales tax. The Salem sales tax rate is. Oregons sales tax rates for commonly exempted categories are listed below.

The Oregon sales tax rate is currently. Rates include state county and city taxes. The state sales tax rate in Oregon is 0000.

Taxes in Oregon. 3600 cents per gallon of regular gasoline and diesel. Filing Requirements All businesses that report total gross income of 1 billion or more and Portland gross income of 500000 or more on their Combined Business Tax.

The Oregon sales tax rate is currently. Business Tax Return Filing Requirements. Last updated August 2022.

The mill-rate varies from one community to another. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. The lower three Oregon tax rates decreased from last year.

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. Portland Tourism Improvement District Sp. The Portland sales tax rate is.

This is the total of state county and city sales tax rates. For taxfilers that have different federal or State of Oregon filing due dates please read our policy on when your returns are due. The minimum combined 2022 sales tax rate for Portland Oregon is.

The Oregon use tax should be paid for items bought tax-free over the internet bought. Instead of the rates shown for the Portland. Since 1993 the tax brackets have been indexed for inflation.

The OR use tax only applies to certain purchases. OREGON PERSONAL INCOME BRACKETS AND TAX RATES 1930 TO 2020. Portland OR Sales Tax Rate.

This is the total of state county and city sales. Oregon Income Tax Rate 2020 - 2021. In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes.

2022 Oregon state use tax. There are no local taxes beyond the state rate. Required every tax year.

2022 Oregon state sales tax. 2020 rates included for use while preparing your income tax deduction. California 1 Utah 125 and Virginia 1.

View County Sales Tax Rates. Did South Dakota v. The Portland Oregon sales tax is NA.

The County sales tax rate is. Wayfair Inc affect Oregon. The Portland sales tax rate is NA.

This rate includes any state county city and local sales taxes. For example under the South Dakota law a company must collect sales tax for online retail sales if. Portland Oregon Sales Tax 2020 will sometimes glitch and take you a long time to try different solutions.

Tax rates last updated in January 2022. The companys gross sales exceed 100000 or. Exact tax amount may vary for different items.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and. Portland OR Sales Tax Rate. Oregon state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with OR tax rates of 475 675 875 and 99 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

There are ten additional tax districts that apply to some areas geographically within Portland.

Texas Sales Tax Rates By City County 2022

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Origin Based And Destination Based Sales Tax Rate Taxjar

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Tax Policy States With The Highest And Lowest Taxes

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Historical Oregon Tax Policy Information Ballotpedia

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Oc Only 5 States Have No Sales Tax R Dataisbeautiful

Which States Have No Sales Tax Quora

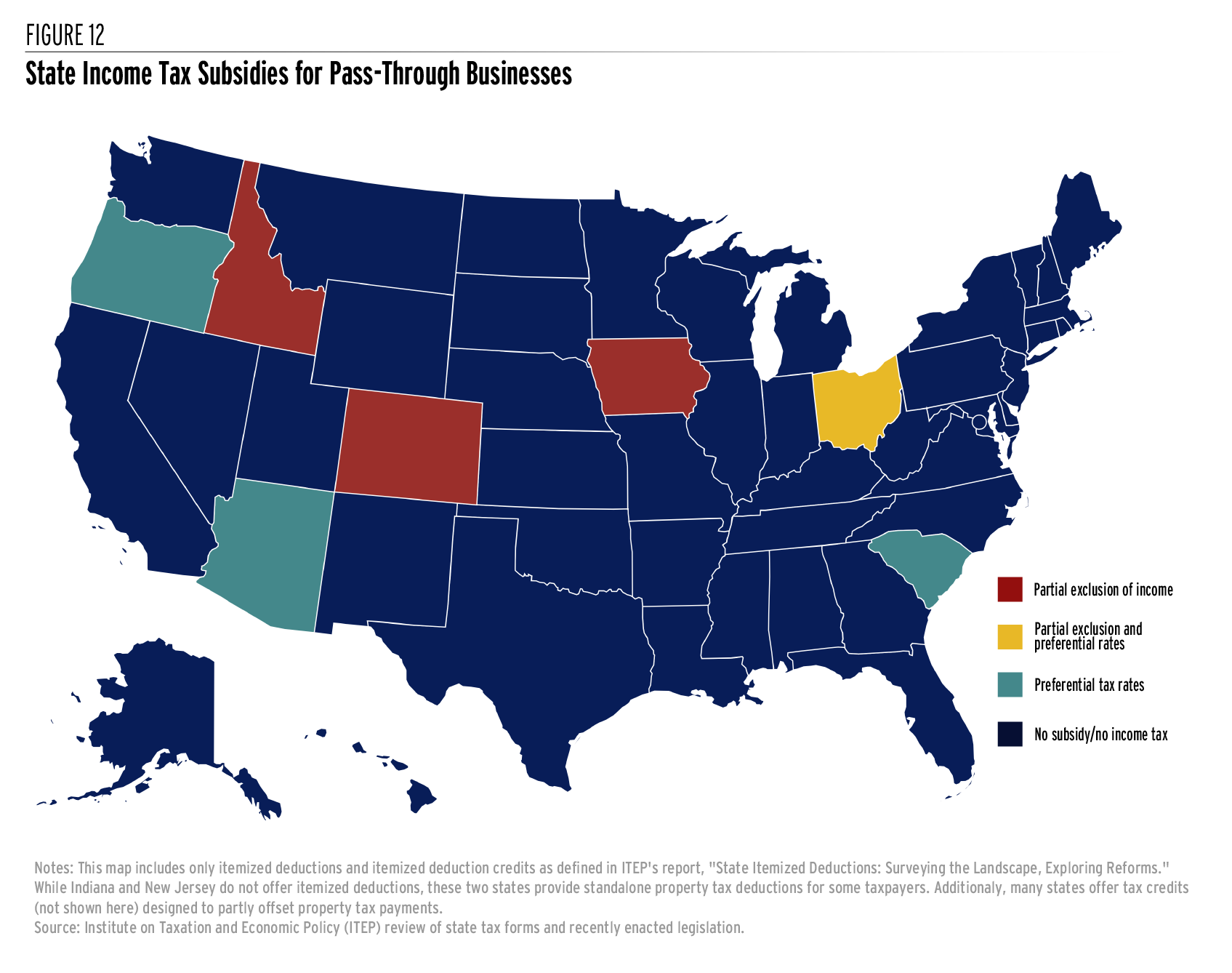

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

States Are Imposing A Netflix And Spotify Tax To Raise Money